Take Advantage of Free Product Listings on Google Search

Reprinted from today’s article in TechCrunch by Sarah Perez

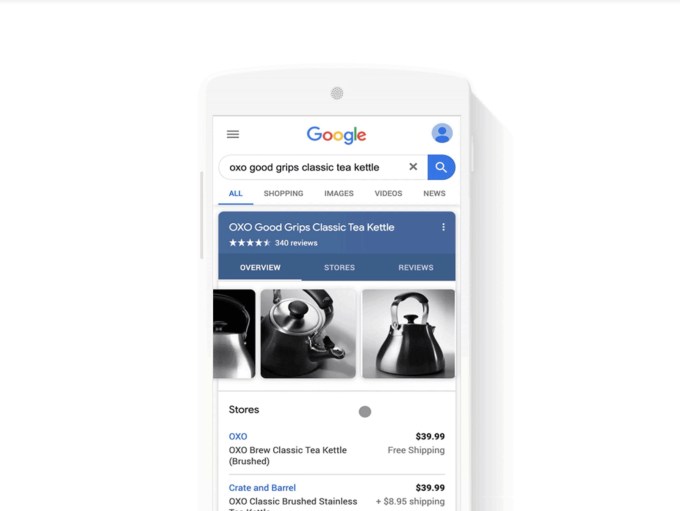

Earlier this year, Google made a significant change to its Shopping search tab in the U.S. to allow the service to primarily feature free product listings selected by Google’s algorithms, instead of paid ads. Building on that change, Google is today introducing a shift to free product listings in the main Google Search results page in the U.S. Before, it would only showcase sponsored links in its “product knowledge panel.”

This panel appears when a Google user searches for a product that has matching listings on e-commerce website. But until now, those links were paid ads. Google says, starting this summer, these panels will instead feature free listings.

This change will roll out first in the U.S. on mobile, followed later by the desktop.

Shopping ads aren’t going away, however. These ads will appear separately at the top of the page, where they’re marked like Google’s other ad units.

Since its shift to free listings in April of this year, Google says it’s seen an average 70% increase in clicks and 130% increase in impressions across both the free listings and ads on the Shopping tab in the U.S. These metrics were based on an experiment looking at the clicks and impressions after the free listings were introduced, compared with a control group. The control group was a certain percentage of Google traffic that had not been moved to the new, free experience.

Image Credits: Google

Google has positioned its shift to free listings as a way to aid businesses struggling to connect with shoppers due to the impacts of the coronavirus pandemic. But the reality is that this change would have had to arrive at some point — pandemic or not — because of Amazon’s threat to Google’s business.

Amazon over the years has been steadily eating away at Google’s key business: search ad revenue. In a report published last fall, before the pandemic hit, analyst firm eMarketer said Google’s share of search ad market revenue would slip from 73% in 2019 to 71% by 2021, as more internet users started their searches for products directly on Amazon.

Now the coronavirus is pushing more consumers to shop online in even greater numbers, much to Amazon’s advantage. The online retailer reported the pandemic helped drive a 26% increase in its first-quarter 2020 revenue, for example. Meanwhile, a new eMarketer forecast estimates that Google ad revenues will drop for the first time this year, falling 5.3% to $39.58 billion due to pandemic impacts on ad spend — particularly the pullback in travel advertiser spending.

Google needed to change its Search service to return more than just paid listings to better compete. Paid listings alone wouldn’t always feature the best match for the user’s search query nor would they show as complete a selection — a problem Amazon’s vast online superstore doesn’t have. But Google’s shift to free listings also incentivizes advertisers to pay for increased visibility. Now, advertisers will need a way to stand out against a larger and more diverse selection of products.

“For many merchants, connecting with customers in a digital environment is still relatively new territory or a smaller part of their business,” notes Google’s, Bill Ready, President of Commerce. “However, consumer preference for online shopping has increased dramatically, and it’s crucial that we help people find all the best options available and help merchants more easily connect with consumers online.”